Finding Edge

If you don't have edge, you're just gambling.

If you’ve been in crypto for a while, you’ve probably heard many people on Twitter saying to “find your edge”. Of course, most of them won’t tell you how to find one, usually because they don’t have any edge themselves, other than reflinks, KOL deals, and using you as exit liquidity.

So how do you actually start finding edge?

What is Edge?

While you can find many definitions for edge, I think a simple definition would be:

An advantage leading to consistent generation of positive returns.

Let’s look at a simple example:

Hyperliquid’s HLP makes money from 3 main sources:

1% of platform trading fees

Backstop liquidations

Market making

Let’s focus on sources 1 and 2, as that’s where most of HLP’s returns come from. HLP’s market making activity is almost negligible now and there are more competitive MMs, so it barely breaks even on MM activity.

Source 1: 1% of platform trading fees

On the surface, getting direct access to a portion of Hyperliquid’s fees seems like an insane edge. Hyperliquid cannot make negative fees1, thus the strategy will always be profitable. This is an example of a low variance edge - you can be extremely confident that you will always be making money.

Source 2: Backstop liquidations

HLP acts as a backstop liquidator for Hyperliquid. When positions are too large to be liquidated in the orderbook and account equity is below 2/3 of maintenance margin, they are transferred to HLP, which uses a custom algorithm to exit these positions.

In a typical orderbook liquidation, if positions are closed such that the maintenance margin requirements are met, any remaining collateral remains with the trader. In contrast, when backstop liquidations occur through HLP, all of the liquidated trader’s collateral is transferred to HLP2. This allows HLP to profit more than a trader bidding for liquidation flow on the orderbook.

Backstop liquidations are an example of an edge with high EV but high variance. On average, backstop liquidations are profitable, but it’s also possible to lose on some liquidations. For example, if a short is backstop liquidated but price keeps rising, the liquidator may need to close the position at a loss.

Characteristics of Edge

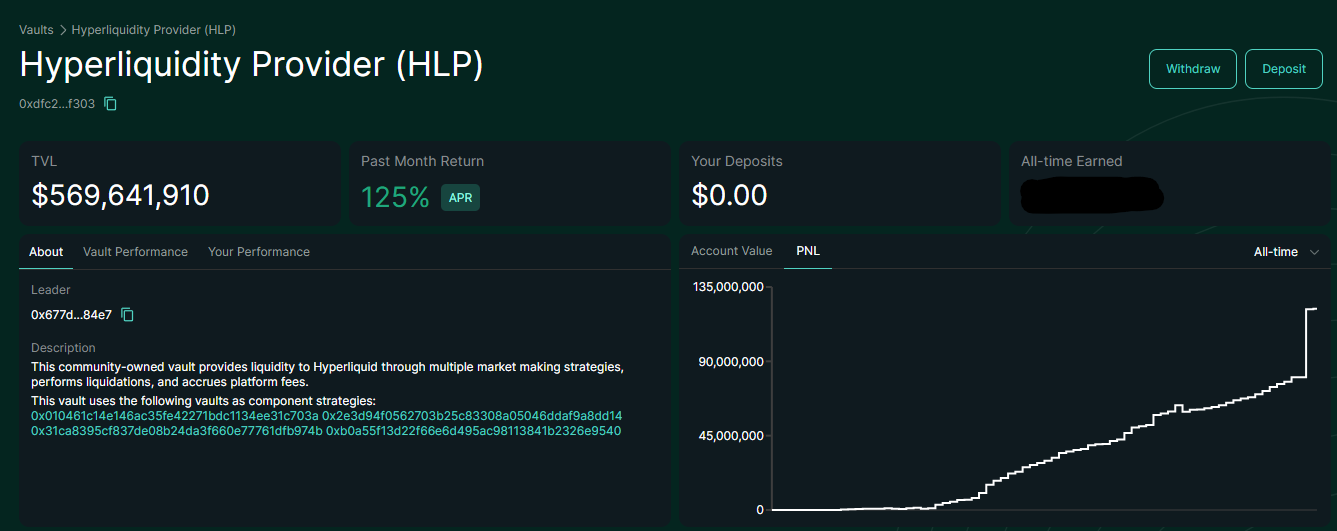

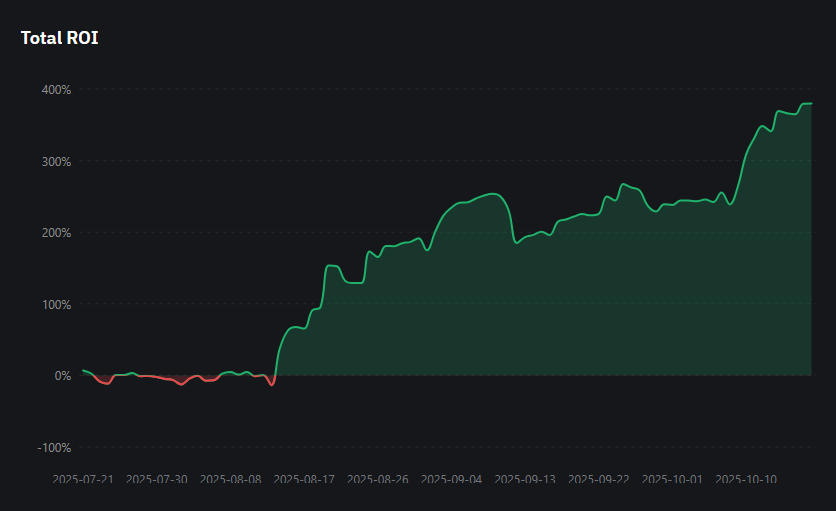

As we saw in the example of HLP, edges can differ in variance. Fee flow is a low variance edge, while backstop liquidation flow is a higher variance edge. These 2 flows contribute to the majority of HLP’s profit and result in HLP’s generally uponly PnL graph. So why shouldn’t we all ape into HLP and call it a day?

Capacity Constrained

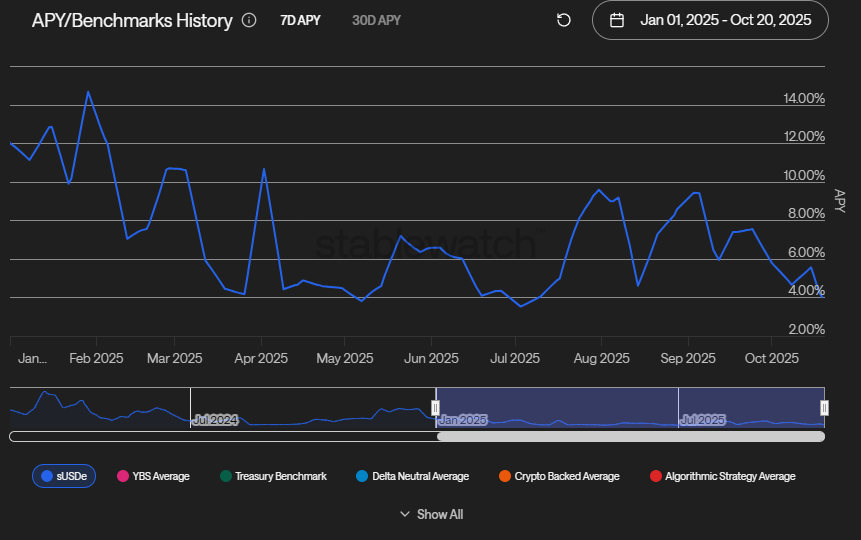

Once noticed, good edges tend to get diluted. More people depositing into HLP lowers the APR since each dollar of profit has to be shared among the dollars deposited in the vault. Since HLP has no deposit caps, market participants can freely choose whether they should allocate their liquidity to HLP. Each market participant has their own expectations of risk and return, and since each participant can freely deposit or withdraw, the market is effectively pricing in a “fair” value for HLP APR.

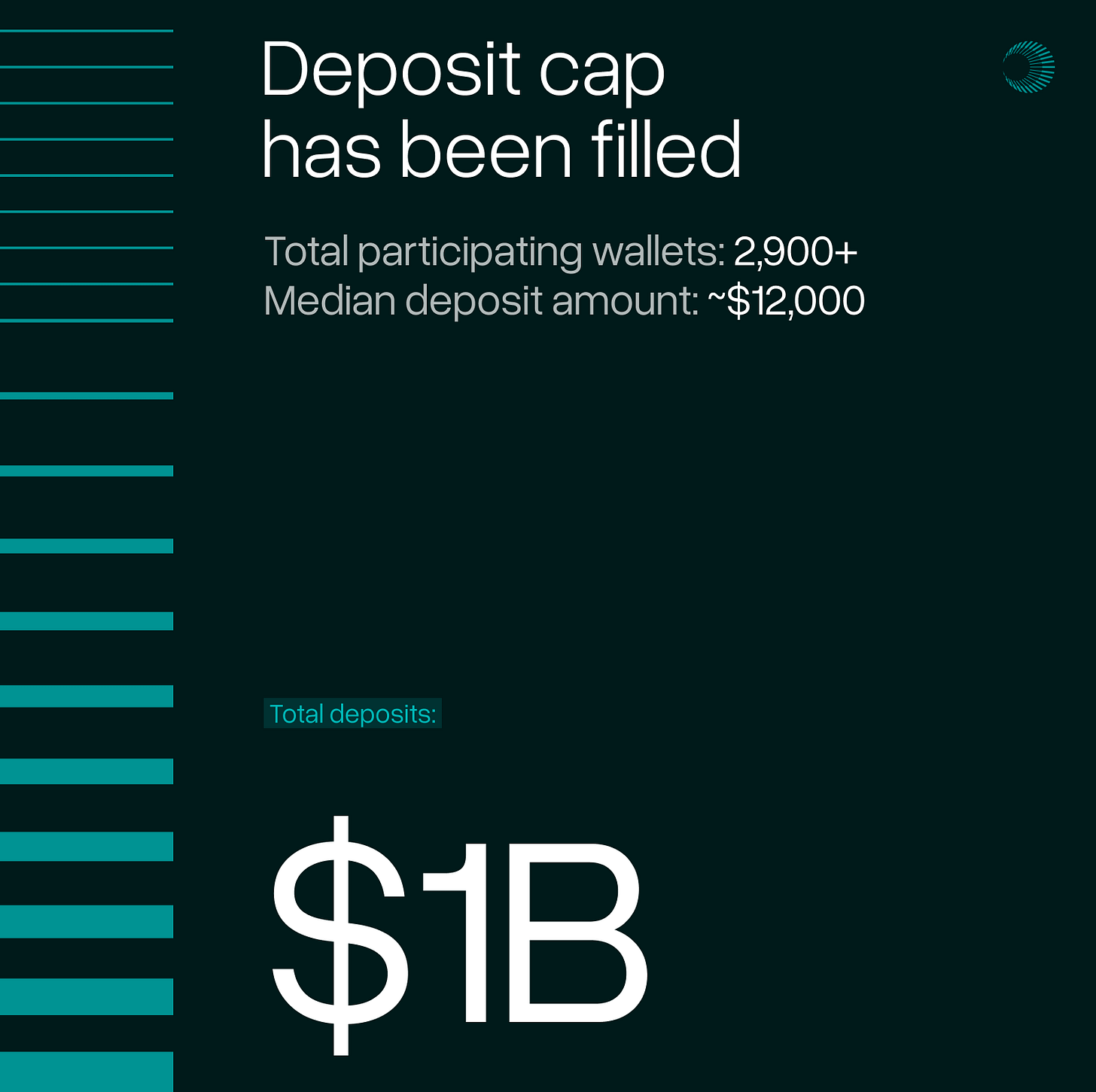

Some of the best edges involve deposit caps. Since not every market participant can deposit, dilution is forcefully limited, allowing successful depositors to achieve outsized returns. The biggest recent example of this was the XPL presale, where caps were limited at $1B. This let depositors secure over 100% APR on their deposited amount if they sold XPL at TGE (even excluding the bonus 9k XPL airdrop each depositor got).

In general, most edges are capacity constrained to varying degrees. An arbitrage opportunity on a low liquidity pair may allow one 4 fig trade to net 2 figs of profit, while a market maker may be able to consistently make 15% APR on 9 figs. As your size increases, returns tend to compress accordingly - optimal strategies differ immensely between 6 figs and 9 figs.

Time Bound

All edges are temporary. Some last longer than others.

Generally speaking, the lower the variance and risk, and the higher the EV and capacity of an edge, the faster it will be eroded.

Consider a simple example: a latency advantage. If you can consistently receive orderbook information and send orders faster than anyone else, you can frontrun all your competitors. This would be a killer edge for a HFT firm.

Low latency is such a good edge in HFT that trading firms hire multiple PhDs to optimise their infrastructure and reduce their latency as much as possible. As multiple firms constantly compete with each other on latency, any edge the dominant player had slowly gets eroded as their competitors figure out how to lower their own latency.

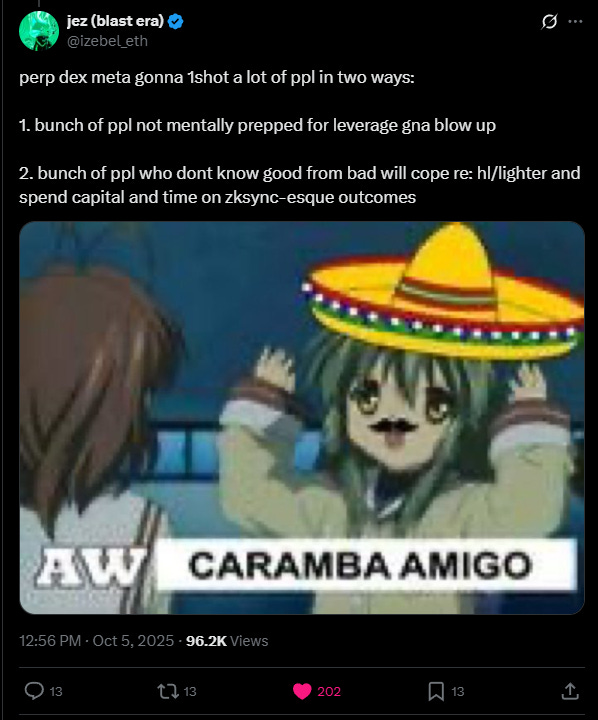

On the other end of the spectrum, you can have more vague and “softer” edges which can last much longer. For example, Jez is very good at identifying good new perp dexes, ranking among the top point farmers on both Hyperliquid and Lighter. Cobie is historically very good at VC investing.

These edges take much longer to erode since they are very discretionary, relying on past experience and softer skills. There is no “metric” like latency to beat. However, their discretionary nature also makes these edges much higher variance than more quantitative edges.

The “Edge Trilemma”

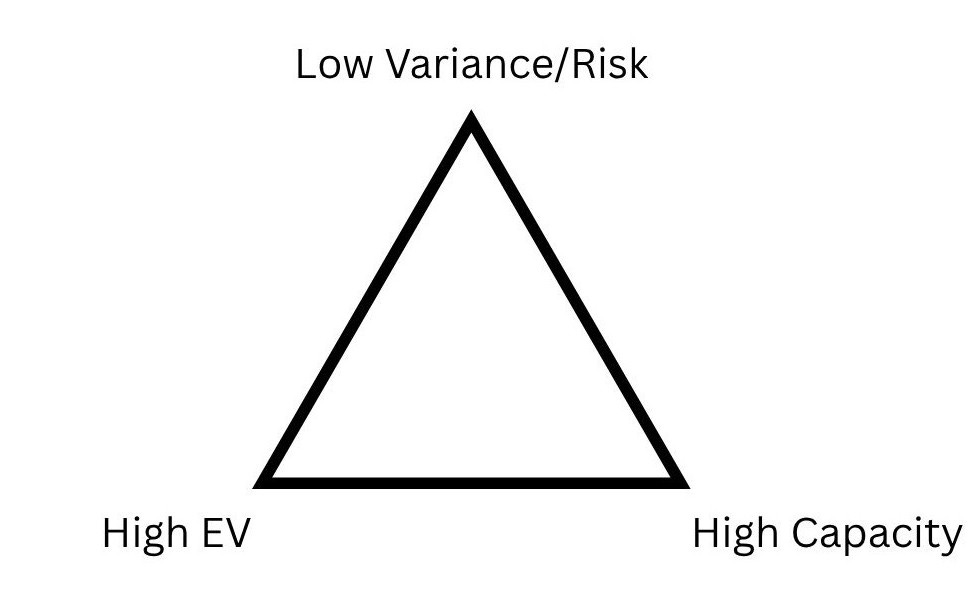

The quality of an edge can be summarised in three factors:

EV (Higher is better)

Variance/Risk (Lower is better)

Capacity (Higher is better)

However, it is often impossible to optimise for all three. You can usually optimise for two out of three, which is why I call it the “Edge Trilemma”.

Let’s look at some examples of each case.

High EV + High Capacity, High Variance

Good directional traders and investors fall into this category. Directional trading and investing is a highly scalable skill, and the best traders can achieve highly +EV outcomes. However, variance suffers, and drawdowns are inevitable in directional positions.

High EV + Low Variance, Low Capacity

Many opportunities in DeFi lie in this category. Leveraged looping on stables can yield high 2 digit or low 3 digit APRs, but are often constrained by limited borrow liquidity. Arbitraging pairs with temporary dislocations in fair value can give consistent risk-free profit, but is often limited by liquidity. These strategies are not easily scalable, and that is one of the main reasons why they exist - larger players don’t want to waste time on these small opportunities.

Low Variance, High Capacity, Low EV

Many strategies by whales and institutions fall into this category, such as:

Market making on a big exchange

Lending stables to lending markets

Basis farming (i.e. farming funding rates)

Generally, these strategies are very safe, but usually only outperform the risk-free rate by about 2x. If you’re below 7 figs, you shouldn’t be allocating most of your capital to these strategies.

The Holy Grail: High EV + Low Variance + High Capacity

These forms of edges are extremely rare, and usually only exist because they can get eroded away very quickly, or because their EV appears low at first but increases rapidly over time. Examples include:

Participating in XPL presale (such a good edge that it eroded within minutes)

Market making on Hyperliquid during the points program (points used to be valued in the single digits, they are worth around $200 today)

So how do you find edge?

Now that we’ve discussed what edge is and some of its characteristics, we can come to the important question:

How do we actually find edge?

While there are many different types of edge, I believe there are a few guiding principles to finding edge that are useful regardless of which area you eventually decide to hone your edge in.

Look where no one else is looking

Edges usually exist because not enough market participants are aware of its existence. Thus, you should aim to look at places where no one else is looking. These can be old, dying places which have faded out of people’s memory, or places that are so new that few people even know of their existence. When less participants are available, inefficiencies are more likely to arise.

I was recently looping sUSDE/USDE with 5 figs for over 100% APR in liquid emissions (not a shitcoin) on a dying protocol. This lasted for almost a month before a larger player stepped in and killed the edge.

Try new things

All else held equal, newer things always have more potential than older things - they have more room for growth, more ways to incentivise usage, and grab attention more easily.

Crypto is the only place in the world where you get airdropped free money for trying out new things early. Don’t waste that opportunity - even the worst perp traders of all time got bailed out by the Hyperliquid airdrop, and more will get bailed out by the Lighter airdrop.

For example, if you specialise in automated trading, look out for newer venues where you will have less competition. The API may be wonky and the latency may be bad, but you will mostly be trading against retail flow that pushes market orders to farm points via volume. Also, you will often get free points which may turn out to be a huge airdrop. If you can find edge, it might take months for a competitor to figure it out since they’ll be starting from square one.

Laziness and complacency are killers. Always be on the hunt for new things, try them out, and evaluate their potential.

Be fast

I don’t think I need to tell you that crypto is a fast moving industry. And in a fast moving industry, you need to be as fast and early as possible to preserve your edge.

Hyped FCFS presale coming? New cap raise on a crazy good yield farm? Set reminders for when it opens, bot your way to get in, find the contract address earlier.

This also ties in with the point about trying new things. When a good new thing comes, everyone starts at square one. If you can find edge and keep refining it faster than the competition, you’ll keep winning.

Specialise in a skill

He who chases two rabbits catches neither - GCR

Crypto is a very wide industry with many different sectors. I recommend specialising in one or at most two skillsets - the industry moves so fast that it is impossible to retain edge in every possible sector.

Here’s a short description of some of the main skillsets in crypto:

Yield/Airdrop farming

This is the skillset I would recommend most people to specialise in. It doesn’t require much technical knowledge, can scale very well, and is generally low risk.

Yield can broadly be categorised into pure yield and airdrop yield. For example, if you loop PT-USDE against USDE on a lending market running a points program, you get pure yield from the PT appreciating more than the borrow cost of your USDE, and airdrop yield in the points from the lending market.

Pure yield is naturally much lower variance than airdrop yield, since you can easily calculate it. Airdrop yield is much harder to estimate, since the token valuation can depend on market conditions, project growth, tokenomics, and more.

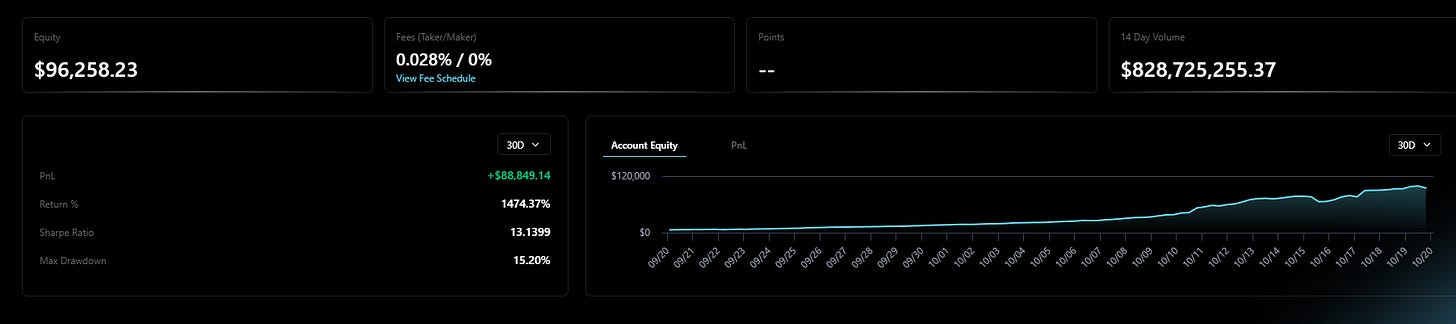

Automated/Systematic trading

If you’re a trader in this category, your edge will generally come from hunting alphas or betas.

Alphas are the price being wrong. A dumb TWAP algorithm might be market buying only in the first minute of every hour on a low liquidity instrument. A buggy perp dex might display the wrong funding rate on the UI, and traders might be paying way more in funding than they think they are. Alphas usually don’t exist for very long and get traded away eventually.

Betas are risk premia. Stuff like momentum, mean reversion, funding rate patterns, most shitcoins going to zero. You get paid for taking directional risk, but you will inevitably experience drawdowns. Betas exist because there’s not enough money in crypto to make every single instrument efficient.

This specialty can be extremely high EV and low variance if you find an edge, but it is far more capacity constrained than yield farming, especially in HFT.

Discretionary trading/investing

This is undoubtedly the most scalable skill in crypto. You can’t make 100% APR on 9 figs being delta neutral, but you can do it as a discretionary trader or investor.

However, it is also extremely hard to get good at this skill. It is extremely high variance, and most traders will statistically lose. It also requires constant adaptation - plenty of OG traders last cycle got rinsed this cycle.

I would not recommend only specialising in this skillset. Rather, combine it with another lower variance skillset. For example, when yield farming, your discretionary experience will allow you to get a better idea of which airdrops have potential and which ones will be worth dust.

Onchain sleuth

If you run your own onchain analytics, you can often find information before others. For example, you can frontrun whales TWAPing into illiquid coins, you can check for suspicious movements of big amounts of supply, and so on.

However, the more convenient the tooling is and the longer people have been actively trading on the blockchain, the more your edge will erode as competition emerges. There’s too much competition on Solana now, but running analytics on BNB or Plasma? There’s probably less competition there.

This is a useful tool to have, but I recommend combining it with another skill. On its own, it usually doesn’t scale very well and is still subject to high variance.

Manage risk

No matter how good your edge is, it doesn’t matter if you can’t manage risk. You should aim to never get even close to zeroing out. Why?

It’s a lot harder to make money when you don’t have it. A 50% loss requires a 100% gain to break even.

Your edge won’t last forever.

Most people tend to compare their current net worth with their peak net worth, feel the need to make it back quickly, and take too much risk and zero out again.

So how do you manage risk? Here are my personal recommendations.

Offramp profits occasionally, and don’t put them back into crypto. Even if you somehow zero out in crypto, you have a safety net IRL.

Never risk your entire portfolio on one position.

Spread your net worth across banks, wallets, and exchanges in case one or multiple get compromised.

Follow best security practices.

Size bigger when you have higher conviction, and vice versa.

TLDR

Try new things, look where other people aren’t looking, find your specialty. Keep looking for new edges, and manage your risk such that you will never come close to zeroing out.

Assume for the purposes of this example that we are ignoring the possibility of Hyperliquid or HLP being exploited or drained.

Assume cross margin in both the orderbook liquidation and backstop liquidation scenarios.

gud article

gud one, quite clear