The Lighter Thesis

With the Lighter TGE coming very soon, I’ve seen many people share their takes on it with varying levels of detail. Sadly, I see many widespread misconceptions from shallow research, and a general lack of understanding of the Lighter revenue model.

In this article, I aim to clear up common misconceptions on Lighter, show how Lighter is a viable competitor to Hyperliquid, and explain why I believe Lighter is a strong buy on TGE.

What is Lighter?

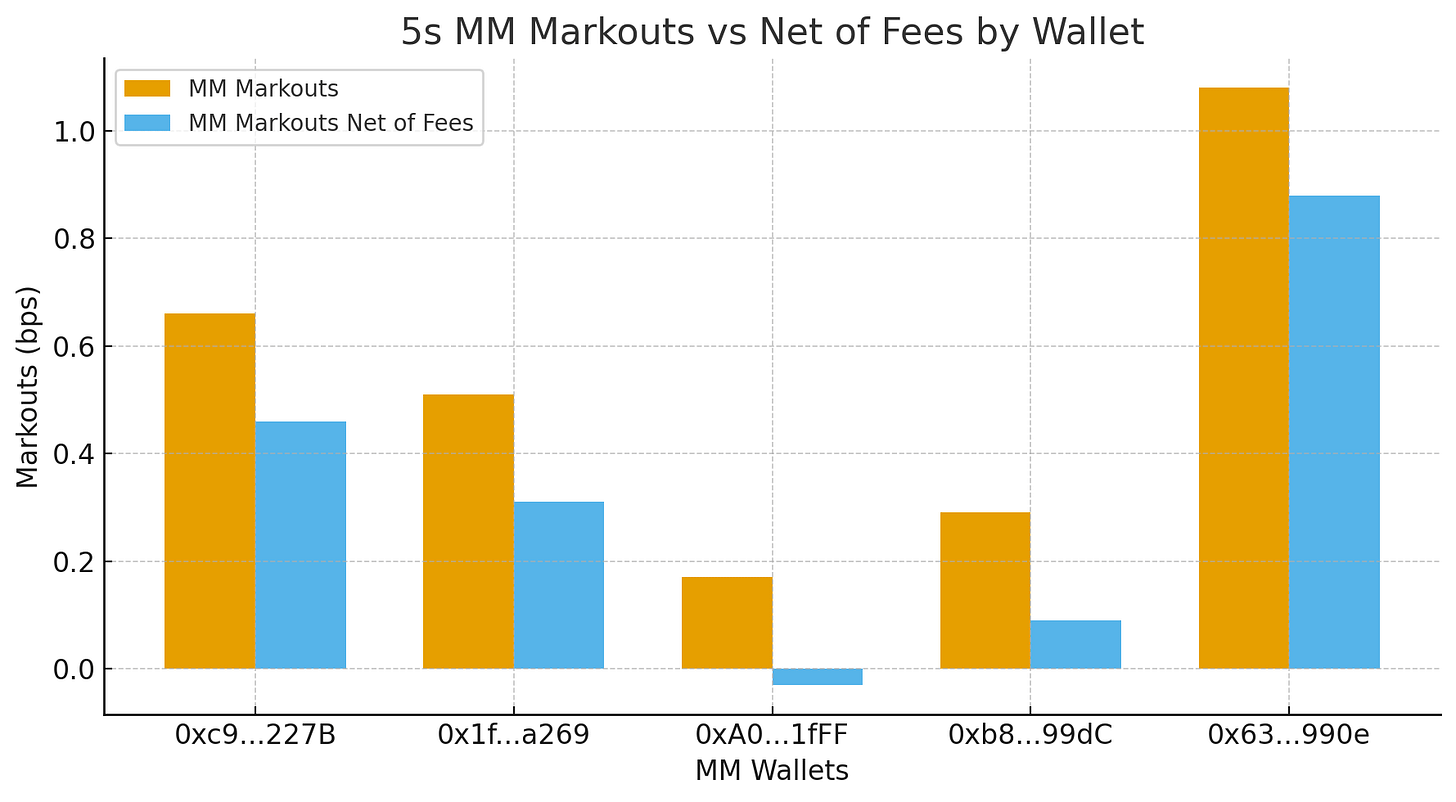

Lighter is a perp dex with zero fees for retail traders, built as an Ethereum L2. Its main competitor Hyperliquid charges fees for retail, and runs on its own L1, consisting of HyperCore and HyperEVM.

How does Lighter generate revenue?

If Lighter charges zero fees for retail, how do they have any revenue?

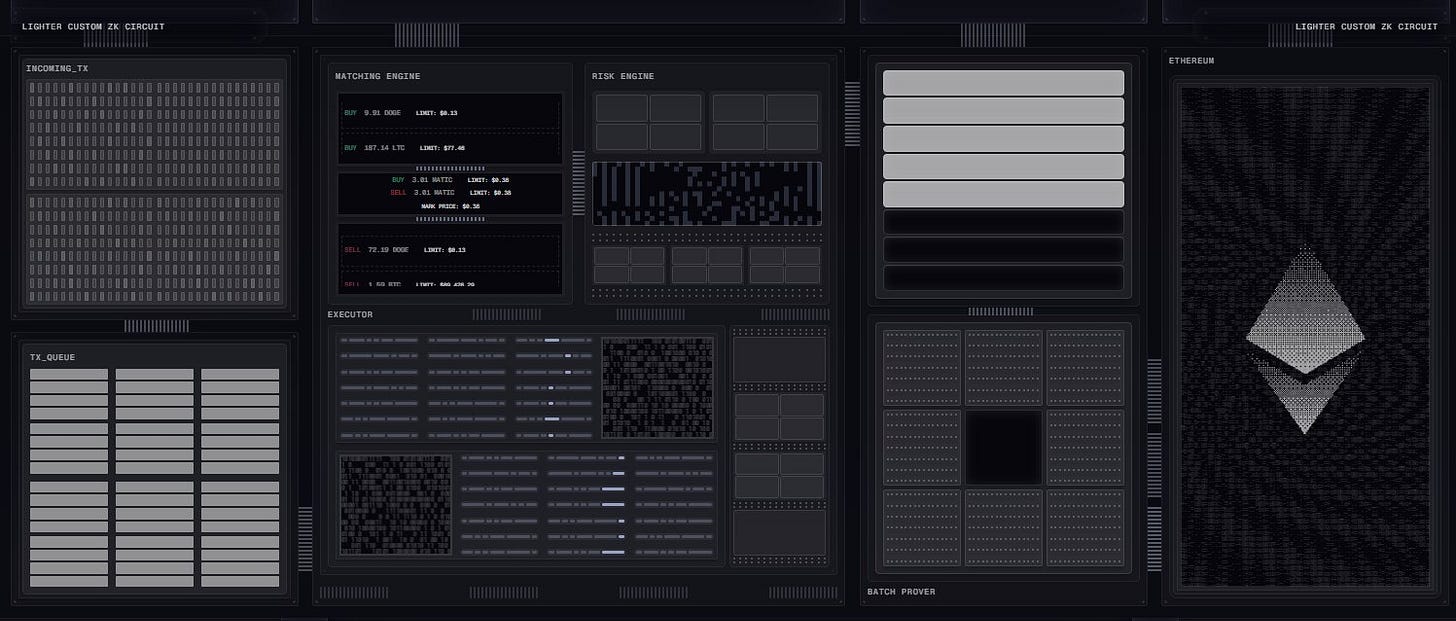

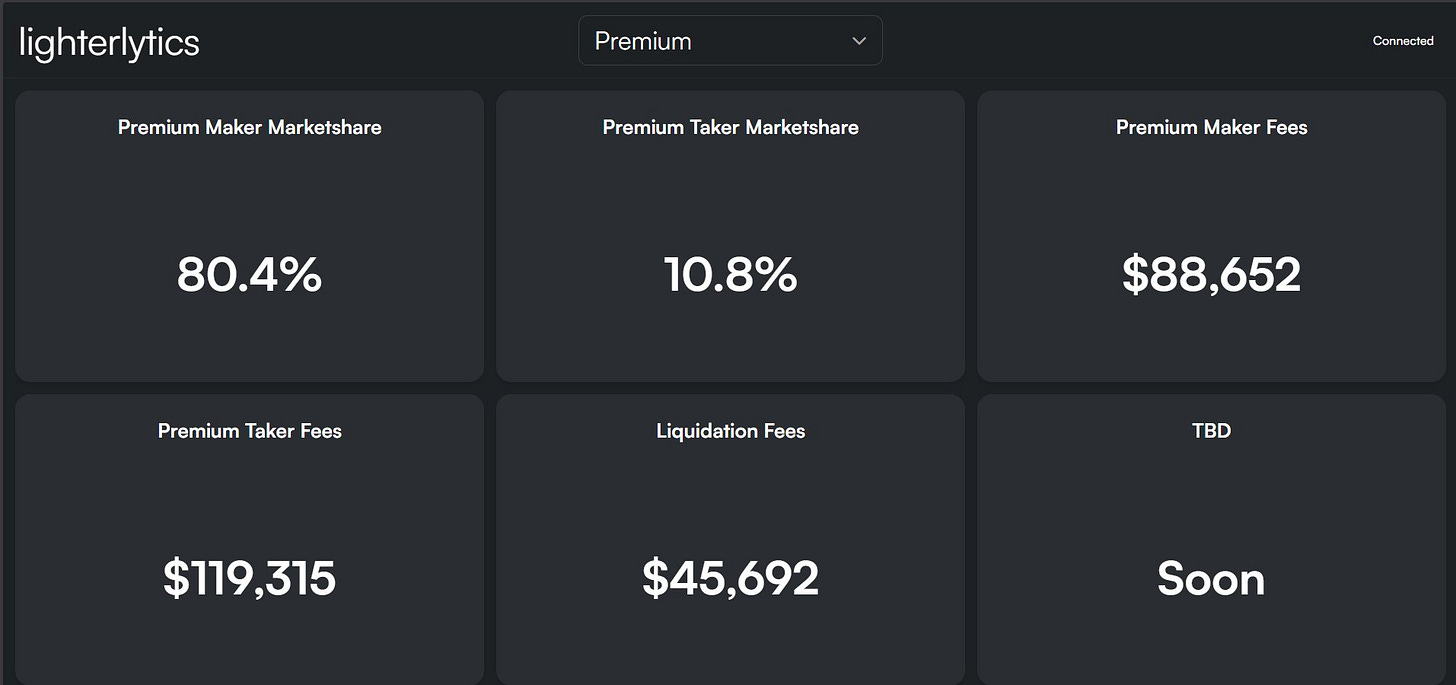

Lighter has 2 account types: standard and premium. Standard accounts pay zero fees, but have a small added latency. Premium accounts are meant for MMs and have no added latency, but pay 0.2bps maker / 2bps taker fees. These fees make up the majority of Lighter’s revenue (the rest comes from liquidation fees).

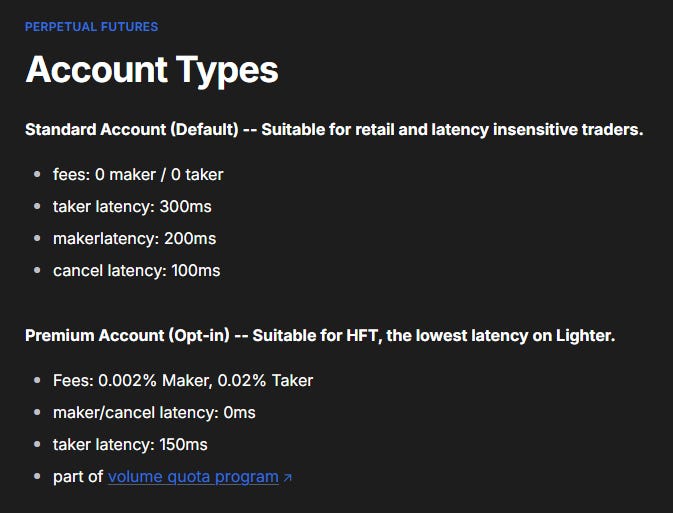

A common misconception is that since Lighter has no fees, retail traders pay through increased spreads instead. This is false -- Lighter has extremely thin spreads which are comparable to Hyperliquid on majors and most alts. You can easily visualise this on liquidview.app for reference.

Instead of paying through spreads, retail users on Lighter trade fees for increased latency. Why is this a good tradeoff?

Consider this example: If you submit a taker order with a 1 minute latency (exaggerated for the sake of example), your total execution cost is

Fees + Spread + Random walk in price over 1 minute

Unless your edge is on a timeframe of minutes, the random walk in price doesn’t actually matter in the long run since it roughly averages out to 0.

Now consider that Lighter’s real taker latency for retail is 300ms. Unless your edge requires precision to miliseconds/seconds, there’s effectively no added cost to your trading. So your total execution cost is effectively

Fees (0) + Spread + Random walk in price over 300ms (~0)

which equals

Spread

This makes Lighter unarguably the best venue for retail execution on pairs which have thin spreads and sufficient liquidity (all majors + most alts).

Why is revenue sustainable?

Many people have argued that Lighter’s revenue is unsustainable because it relies on incentives (points). While I agree that volume metrics were temporarily inflated and there was some wash trading, I don’t think this means revenue is going to die off after incentives end.

As we established earlier, Lighter currently has the lowest execution cost for retail traders on majors and most alts. This is a significant moat, and highly effective at attracting retail traders. More retail traders in turn attract more MMs, naturally increasing metrics such as OI and volume.

A common counterargument is that spreads are currently only thin because MMs are incentivised through points, and that spreads will be forced to widen when MM incentives are removed. This will in turn increase the execution cost for retail, leading to negative reflexivity.

Firstly, I don’t think most MMs would be ok with operating at a loss just because they’re eventually getting an airdrop. Secondly, even if MMs had to slightly widen their spreads due to reduced retail flow, given that Lighter’s maker fees are only 0.2bps (0.002%), spreads would only need to be widened slightly for MMs to profit. Overall execution cost for retail would still be much better than Hyperliquid’s 1.5bps/4.5bps maker/taker base fees.

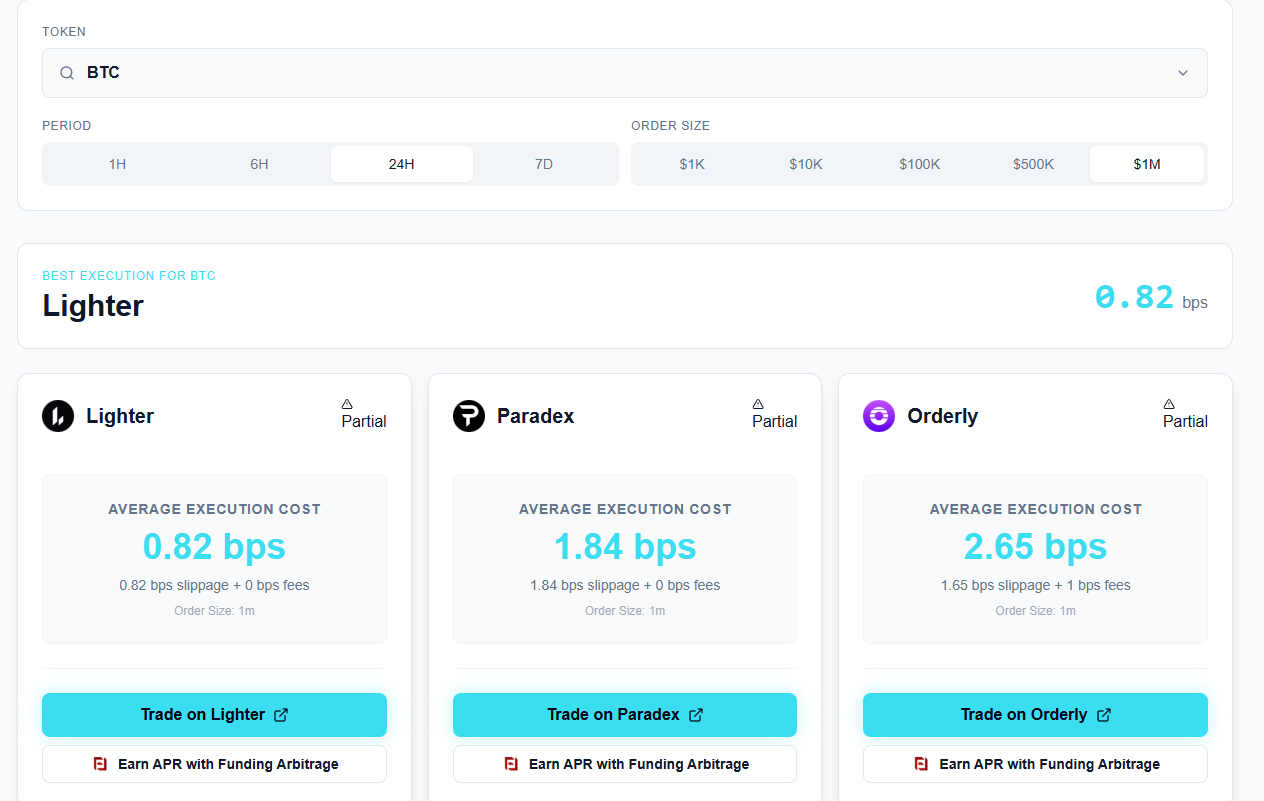

There is also empirical data from @PriorXBT back in October showing that MM markouts net of fees were generally positive, and that MMs do not need to rely on incentives to profit.

Overall, the narrative that Lighter only generates revenue because of incentives is extremely overblown. While there was certainly some wash volume resulting in temporarily inflated revenue, Lighter's fee and latency structure is a genuine innovation which has led to the best retail execution currently available among perp dexes.

Why should revenue increase?

Short term

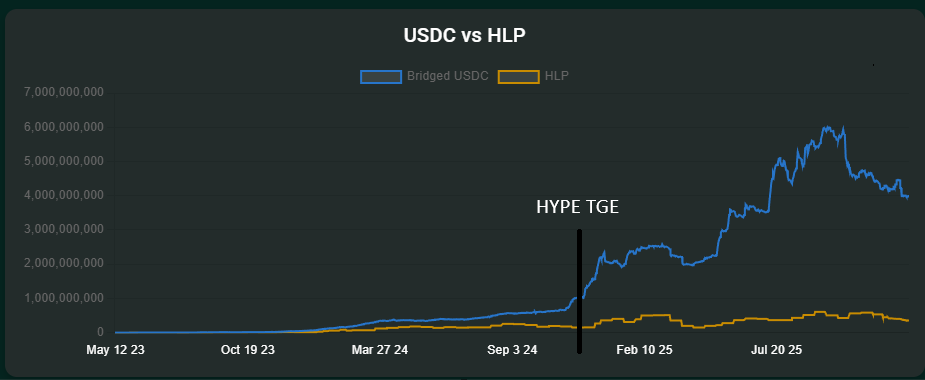

Assuming LIT TGEs around 4b FDV, a 25% airdrop would inject $1B of TVL straight into Lighter. If you recall what happened during the HYPE TGE in 2024, most airdrop recipients who sold did not take their funds off Hyperliquid immediately. Rather, many of them continued trading with the funds, increasing Hyperliquid’s revenue.

I believe the LIT TGE will play out similarly. Most of the capital injected will remain on the exchange, increasing trading volume and thus increasing revenue.

I also expect Lighter to be the most liquid venue to trade spot LIT (and possibly the only venue for the first few days), so potential buyers will have to deposit into Lighter to buy LIT, leading to even more TVL inflow.

Long term

Lighter’s zero fee structure attracts more retail traders, which in turn attract more MMs. Retail and MMs have a symbiotic relationship -- one cannot exist without the other. Retail provides soft flow to MMs, and MMs compete with each other to benefit from this flow. The process of MM competition makes spreads thinner, facilitating lower execution costs for retail.

I am confident that Lighter’s zero fee structure is a huge moat, but there are other factors that determine which exchange retail traders choose to trade on. Why do so many whales still trade on Hyperliquid?

I believe it’s mainly due to these reasons:

Stability. Hyperliquid was one of the only exchanges, CEX or DEX, that functioned perfectly as intended during 10/10. It has also been around for longer, is more battle tested, and has lower downtime than Lighter.

Liquidity. While Lighter’s liquidity is very good, it is still not as deep as Hyperliquid’s, and Lighter has not yet shown that it can facilitate price discovery.

Simply put, these traders value stability and liquidity highly, and are willing to pay fees for it. Fortunately, this is something that can be solved over time. As Lighter matures, it should experience less downtime and eventually start facilitating price discovery. As stability and liquidity improve, more whales will be incentivised to move from HL to Lighter for cheaper execution.

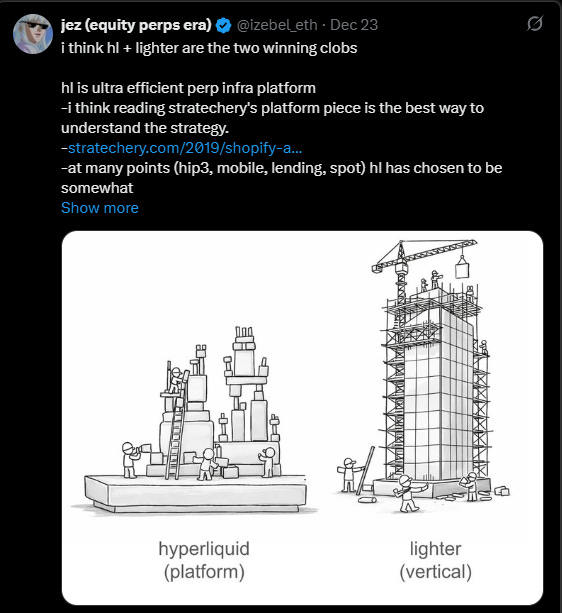

Lighter’s Scaling Model vs HL

Hyperliquid builds horizontally, designing itself as the “AWS of liquidity”. It provides infrastructure for perp and spot CLOBs, allowing external builders to build on top of it through builder codes (eg. Phantom, Based), spot deployments (Unit) and HIP-3 (TradeXYZ/Felix/Hyena).

Lighter builds vertically, integrating all the essential components into one stack. Both spot and perps (crypto, RWA, equities) are deployed by the Lighter team. Lighter has a lot more control on what gets built on it, but requires more manpower to build all these features (which is likely why the Lighter team is much bigger than HL’s)

Personally, I think both are very viable business models, and both will succeed in their own niche. But with Lighter trading premarket at 3.5B and Hyperliquid trading at 25B, I think it makes a lot of sense to bet on Lighter's growth as the only serious competitor.

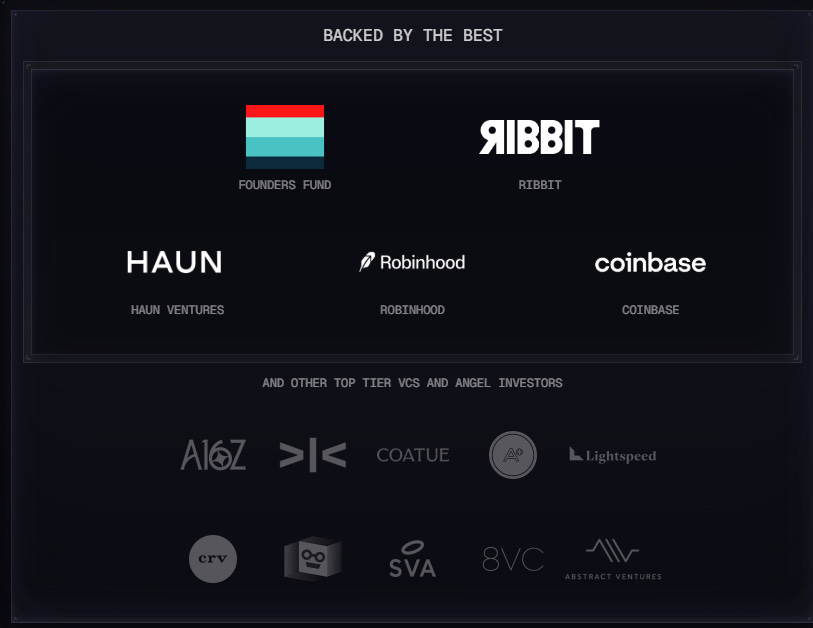

The impact of VCs

Lighter recently disclosed that they raised $68 million at a $1.5 billion valuation. I’ve heard many people say that VCs and liquid funds won’t bid because they already have exposure from this funding round. I think this will be very inaccurate for the following reasons:

$68 million is actually very little money when you put it into perspective.

Paradigm holds almost 19.1M HYPE which they bought at an average price of $16.46, for a total cost of ~$315 million. That’s ~4.6x of the $68 million which Lighter raised from multiple funds.

The Lighter funding round was also very oversubscribed (around 5-6x) and many funds did not manage to get in at all. Even the funds which got in didn’t manage to get real size in. The Lighter homepage already shows 15 investors, so each investor is getting less than $5 million in on average. There are probably more investors that aren’t even listed on the homepage, so the real average is likely even less.

Most funds missed HYPE, and Lighter is the clearest competitor.

If you want to gain exposure to the perp dex sector, the only viable liquid token to bid right now is HYPE. However, at a $25 billion FDV, it’s not as attractive as it was at TGE (although I think it is a good buy at these prices!)Lighter is currently trading premarket at $3.5 billion FDV. That’s 14% of HYPE’s FDV, and is considerably more attractive considering that it’s the only viable competitor to HL and its metrics keep increasing.

Also, if you already hold a massive amount of HYPE (i.e. Paradigm), it makes sense to hedge your bets by getting exposure to Hyperliquid’s main competitor as well. In fact, Paradigm already invested in Liquid, a mobile app integrating both Hyperliquid and Lighter.

For these reasons, I think there will be a lot more liquid inflows into LIT than people are anticipating.

How badly will MMs dump?

Recall that MMs on Lighter earn points for their MM activity on Lighter. Thus, they will likely hold a decent proportion of the total point supply. Since most MMs have mandates that prevent them from holding LIT exposure, most of them will probably be price insensitive sellers. If we can quantify what percentage of the point supply they hold, we can get a sense of how much price insensitive selling we can expect.

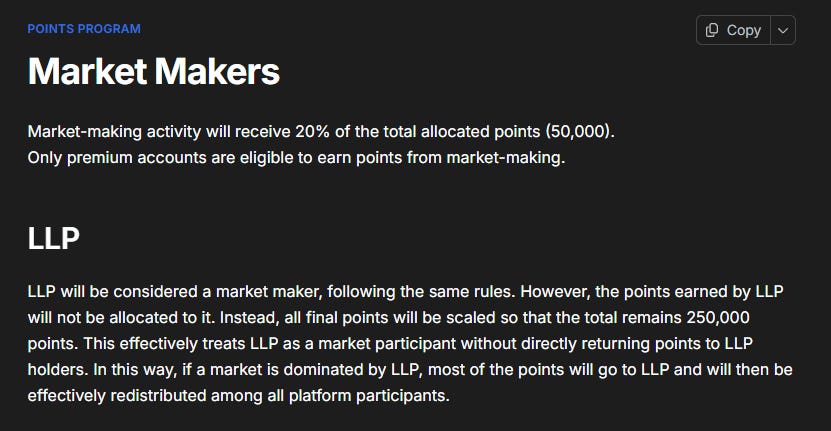

Unfortunately, Lighter has made point balances private for a while now, and now that points are transferrable between accounts, it makes a detailed onchain investigation very difficult. However, we can estimate what percentage of points MMs might hold based on the rules of the points program.

Overall, I would estimate that <20% of the current point supply is held by MMs. Here’s why:

After private beta ended and Season 2 began, 20% of points each week were allocated to premium accounts for MM activity.

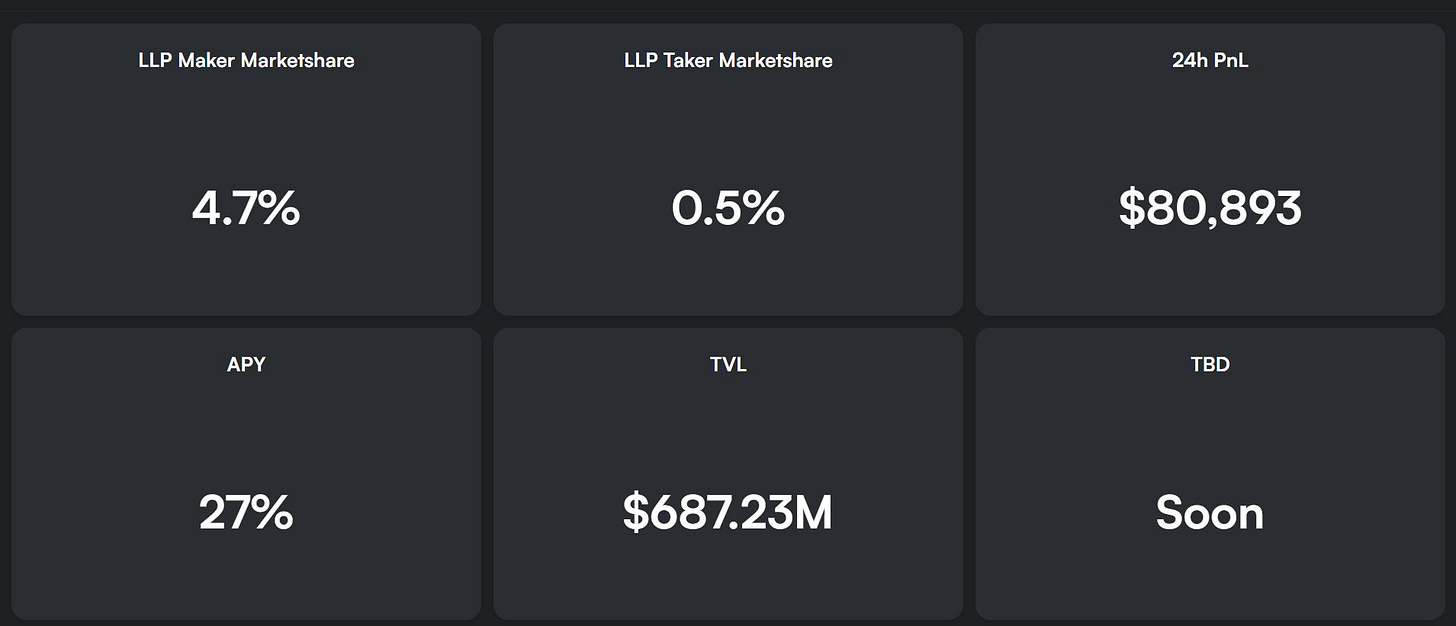

LLP earns points under this program, but points earned by LLP are redistributed to all users -> less points for MMs. LLP currently makes up <5% of maker volume, although I believe it was around 10-20% during the first few weeks of Season 2.

Premium taker marketshare has been pretty consistently <10%, meaning MMs earn almost all their points from the MM program and not the retail program.

During private beta, the leaderboard was mostly dominated by early users, not MMs.

Historical Revenue Warchest

During private beta, all of Lighter's revenue went to LLP, but this stopped after private beta ended on 2 Oct. According to DefiLlama, Lighter has generated $39.4M from 23 Oct to 25 Dec. Averaging this out, we get $39.4M/64 = $616k per day. If we assume that this rate is roughly accurate from 3 Oct to 22 Oct, we get $12.3M of revenue over this period, giving us a total of $51.7M since private beta ended.

Therefore, Lighter likely has a warchest of over $50M in cash that they can use to bid the token on TGE. This would be similar to what Hyperliquid did with the Assistance Fund after the HYPE TGE. Considering how similar Lighter has been to Hyperliquid so far, I would say it’s quite likely that most of this historical revenue will be used to bid the token.

Token Buybacks and Value Accrual

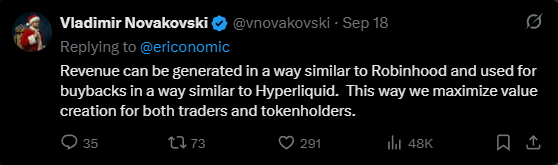

Vlad has publicly stated that Lighter revenue can be used for buybacks similar to Hyperliquid:

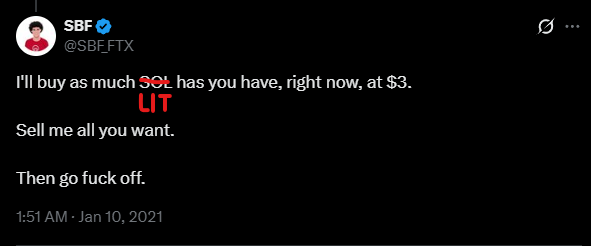

He has also stated that value will accrue to the token:

Unfortunately, he has been vague about how exactly value will accrue to the token, and what percentage of revenue will be used for buybacks. This is the main drawback of the dual token equity model and, in my view, is Lighter’s biggest bear case.

While this is definitely an important consideration for a long term investment, I don’t think that it matters for a short term trade on the timeframe of a few weeks. Short term flows around the TGE period will far outweigh the potential impact of a few million dollars in buybacks each week, and I do not intend to hold Lighter as a long term investment until more clarity around token value accrual is reached.