Finding Edge (Part 2) - Table Selection

This is a follow-up to my original article Finding Edge, which you can read below.

Finding Edge

If you’ve been in crypto for a while, you’ve probably heard many people on Twitter saying to “find your edge”. Of course, most of them won’t tell you how to find one, usually because they don’t have any edge themselves, other than reflinks, KOL deals, and using you as exit liquidity.

In this article, I’d like to focus on one of the most important aspects of finding edge: table selection. This article is quite info dense, but it will provide you with real insight into finding edge, especially in the context of DeFi.

What is table selection?

In poker, you would prefer to sit at a table of drunk, casual gamblers instead of a table of experienced poker pros. In markets, the same concept applies: it’s easier to make money trading against less competent people. Accordingly, you should aim to trade in markets where you know your counterparties are worse than you.

Another key point of consideration is whether the table is positive sum, zero sum, or negative sum. Obviously, it’s better to sit at a positive sum table if possible.

Counterparty selection

In any market, you will be trading against a counterparty. Ideally, you want this counterparty to be as dumb as possible to exploit their inefficiency.

Let’s look at some examples of counterparties you might be up against in various markets.

Perp trading

If you’re trading perps on majors on a major platform with good liquidity (eg. Binance, Bybit, Hyperliquid), you’re going up against the hardest counterparties in the space, and you’ll probably get rekt.

Let’s say you’re trying to build a HFT MM on Binance. Here’s what the competition has:

Superior infrastructure

Superior fee structure / maker rebates

Teams of people who have dedicated decades of their lives to studying market microstructure and extracting edge

You could be the smartest person in the world, but you’ll still lose against them because you lack the resources and experience to compete.

But most of us don’t trade on timeframes measured in milliseconds. What if you’re a manual trader who swing trades or scalps?

You might actually have a chance to make money, unlike in HFT where you will consistently lose money from fees and being picked off by better MMs. However, the odds are still not in your favour: traders still lose money on average, since almost all of them have no real edge. Most retail trading is chasing risk premia at best and noise trading at worst.

Your counterparties when trading majors on longer timeframes are still mainly institutions, with superior access to information, infrastructure, talent, and more. It’s a competitive table, and you’re probably going to be the fish in a pool of sharks.

The solution is pretty simple: move to a pool where you might actually be the shark.

Trade where the pros aren’t (or can’t)

There is simply too much money and competition actively trading majors and on major platforms. The level of competition is so high precisely because there is so much money available if you win - the best competitors don’t want to waste time picking up pennies on smaller markets.

So what do you do as a retail trader? Instead of trading majors, trade low cap alts. Instead of trying to MM on Binance, try MMing on a small perp dex or on prediction markets. Find places where the competition is minimal and where you can dominate.

DeFi

While DeFi is an incredibly wide industry, I’d like to focus on one sector: lending markets. At their core, lending markets only have two parties: lenders and borrowers. However, borrowers (almost) always pay more interest than depositors receive: the difference is paid to the lending market or curator.

A Quick Primer

Before taking a loan, borrowers must first deposit collateral. This collateral is eligible for liquidation if the loan to value (LTV) ratio exceeds the liquidation threshold, set by the lending market depending on the type of collateral and loan.

However, if the collateral deposited by the borrower suddenly experiences an instantaneous and massive drop in value, the value of the loan may far exceed the value of the collateral. Since liquidators have no incentive to pay back the loans to receive collateral of lower value, borrowers can walk away with their borrowed funds, but lenders lose everything they deposit.

Therefore, as a lender, it’s important to research the type of collateral you’re lending against. Lend against the wrong collateral and you get zeroed out or take a significant haircut.

Considerations as a lender

Lenders have two main considerations:

What risks am I taking by lending against this collateral?

Are the risks worth it considering the returns I am getting?

A short term US T-bill currently pays out around 3.5% APR. This is considered the risk-free rate (RFR), and rational lenders must look for yields above this rate when taking on risk.

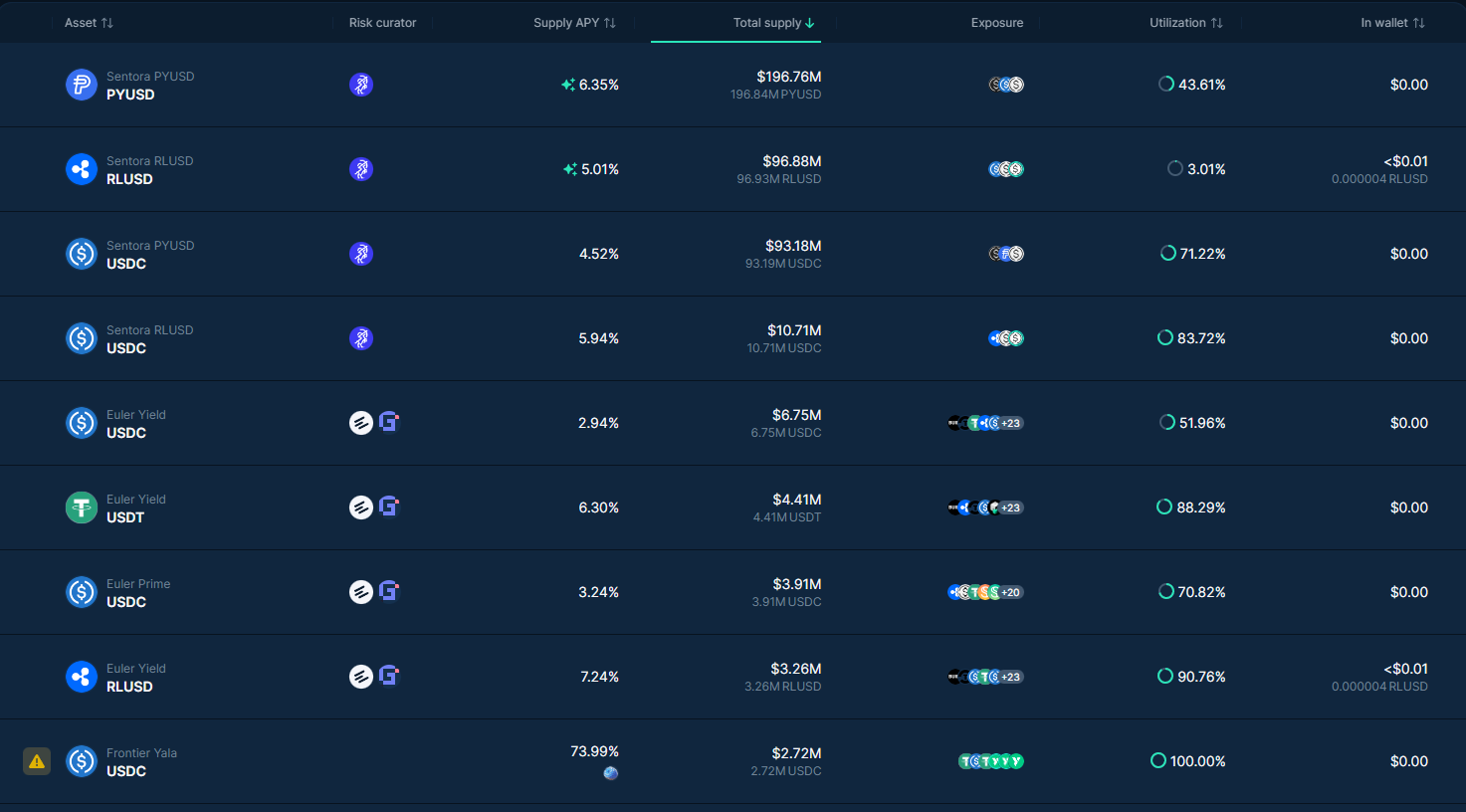

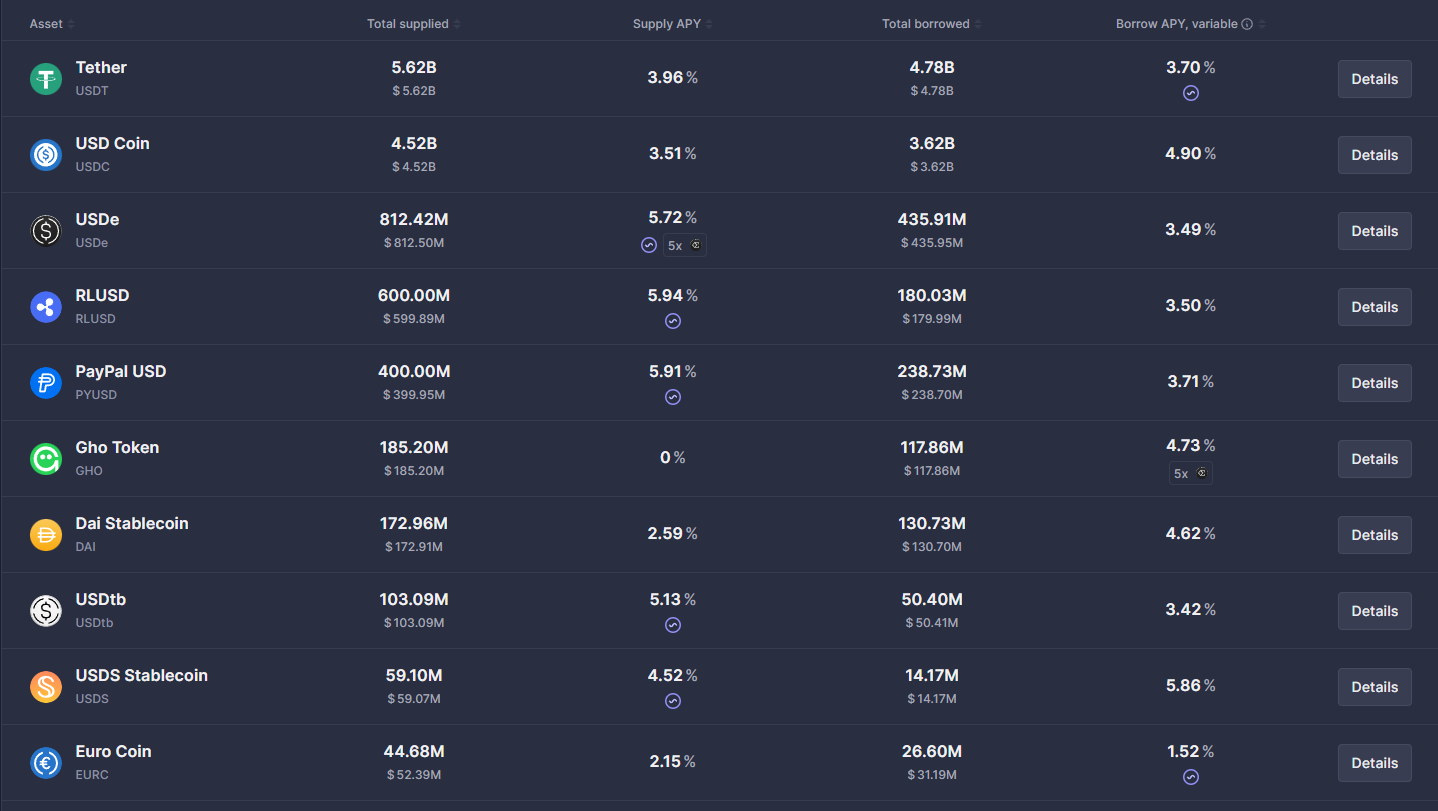

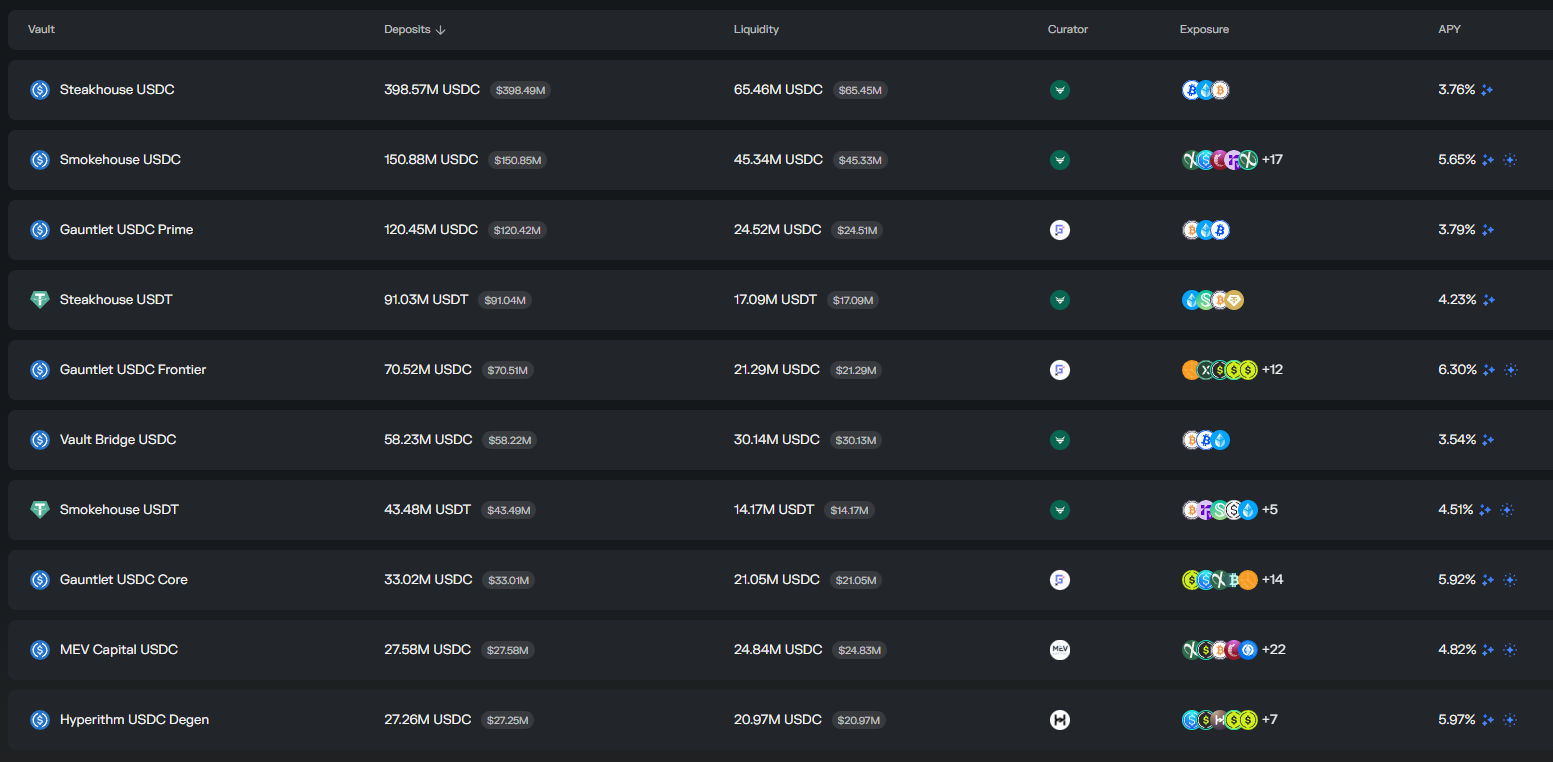

Pictured below are the lending APYs for stables on some major lending platforms on Ethereum mainnet.

Most lending rates are below 5%, and some aren’t even above the RFR of 3.5%. Not great.

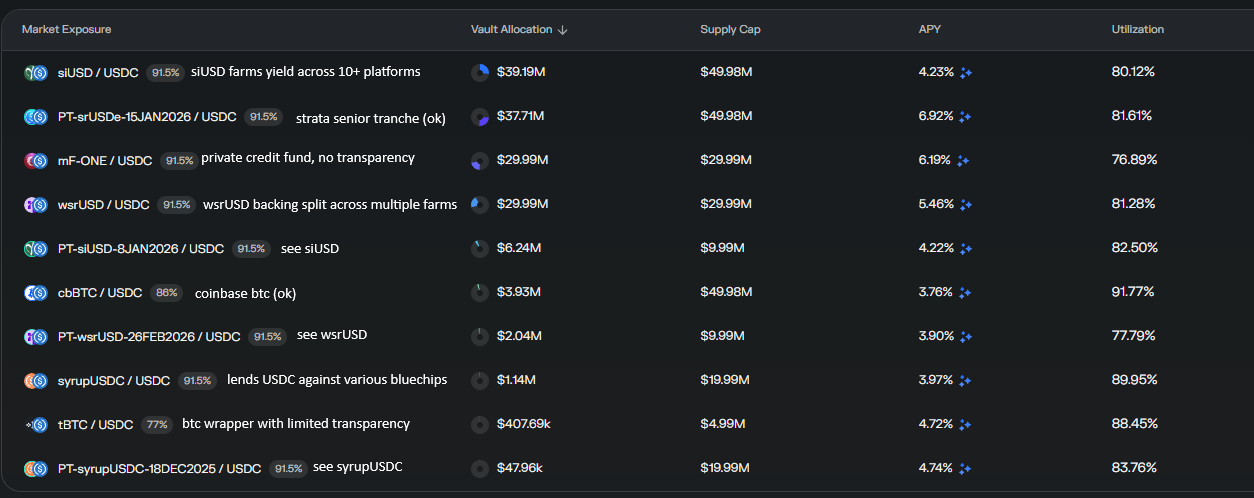

Many curated vaults are also exposed to a wide range of collateral of varying quality. As a quick example, this is what the Smokehouse USDC vault on Morpho lends to, a vault tailored for lending against higher risk collateral:

That’s a wide range of collateral you’re lending against just to earn 5.65% APY, some of which is exposed to other vaults and other platforms. By depositing in this vault, you’re taking on way more risk just to earn 2% above the RFR.

Generally, most stablecoin lenders are earning subpar risk-adjusted returns. This is mainly due to the following reasons:

Lost access to their funds (lots of dead capital in AAVE)

Cannot offramp, or live in a country without a stable currency

Unaware of better risk-adjusted returns elsewhere

Unaware of what collateral they’re lending against

Profiting from lenders

As a borrower, this is exactly the type of counterparty you want to exploit. They are only lending to you because they are forced to or uneducated enough to lend for such low rates.

The core concept behind making money as a borrower is actually very simple:

Find stable, high quality collateral which appreciates over time (typically a PT)

Find a venue to borrow against the collateral at a low interest rate

Leverage up on the interest rate spread

It’s not that simple in practice, and there are lots of other risks to take into consideration, but that’s the core concept. Executing this well and fully understanding the risks is hard, and that’s where a lot of the edge lies.

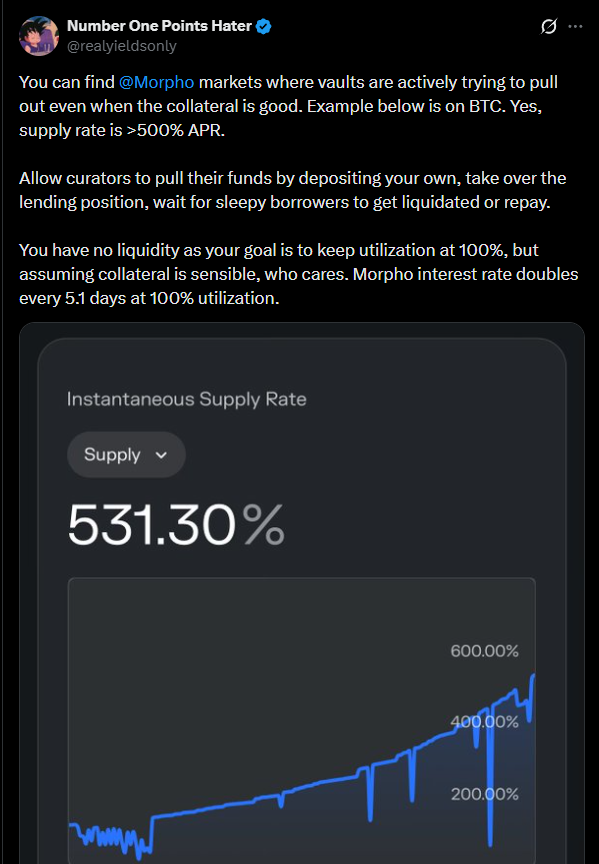

Reversing roles

Not all borrowers are sophisticated, and dumb borrowers can be picked off by smart lenders. However, this is usually more capacity limited, and opportunities can be hard to spot.

A simple example is a borrower on an isolated Morpho market who doesn’t realise that they have borrowed all the available liquidity, so they end up paying increasing amounts of interest due to the interest rate model.

Positive/Zero/Negative Sum Games

Generally, it’s better to play positive sum games instead of zero or negative sum games. Some simple reasons include:

You can still make money if you lose

If you win, you usually get more money compared to zero/negative sum games

What are some examples of these games within the context of crypto?

Zero Sum: Perp trading

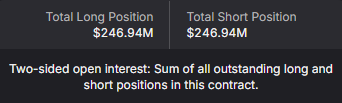

Perp trading is a simple example of a zero-sum game: since every unit of long OI is matched with an equivalent amount of short OI, the net delta across the exchange is 0. Thus, the collective gains and losses of traders on an exchange (excluding fees) net out to 0.

(Technically, the game is negative sum for traders if you pay fees to trade, but let’s ignore that for this example)

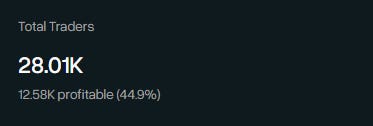

Recall what we mentioned about counterparties — there are a few entities which are consistently profitable in size, usually MMs. These gains are balanced out by the losses of average retail traders.

Positive Sum: Yield Farming

There are many forms of yield farming, such as looping stables, LPing stables in DEXes, lending, incentive hunting, airdrop farming etc. However, many of these activities are part of positive-sum games.

For example, if you’re farming points on a perp dex, you might occasionally wash trade to generate volume. While you lose in the short term by providing soft flow to a MM, you may receive an airdrop that makes up for all your short term losses and more (eg. Hyperliquid airdrop). Both you and the MM win in the end, since the airdrop turns the zero-sum game of perps into a positive sum game.

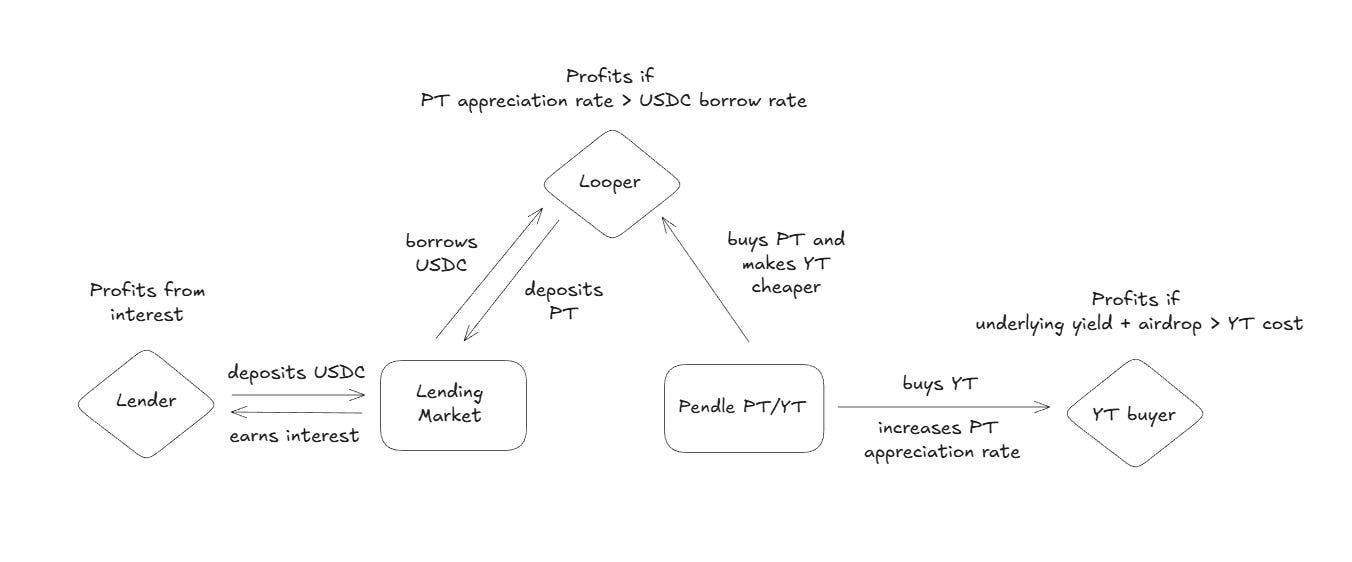

Consider another example: Looping the PT of a yield-bearing stable backed by T-bills against a stablecoin (eg. USDC/USDT). Assume the yield-bearing stable has a points program leading to an airdrop.

There are 3 main parties in this game:

The looper

The lender, providing liquidity for the looper to borrow

YT buyers, who are the counterparty when the looper buys PT

How can all 3 profit?

Looking at them individually:

The looper profits if the PT appreciates at a higher rate than the borrow rate of his USDC

The lender profits from earning interest on his deposit

The YT buyers profit if the underlying yield + profit from the airdrop exceeds the cost of the YT. Note that YT buyers push up the PT appreciation rate.

If the airdrop is sufficiently large, all 3 parties can profit, resulting in the game becoming positive sum.

Negative Sum: Onchain trenching

Onchain trenching is probably the most negative sum game from a trader’s perspective, but too many people are addicted to gambling for a 100x that will never manifest itself.

Value is constantly being extracted from traders through:

Trading tools/terminals charging fees

PumpFun charging fees on the bonding curve

Serial deployers farming creator rewards

Onchain trenchers PvP each other on coins that they know have no value and will all go to 0 eventually, while being farmed by everyone else. Ultimately, most of them have gambling addictions: willing to play a negative EV game for a miniscule chance of huge profit.

TLDR

There are 2 key aspects to table selection: counterparty selection and game selection.

Stop trying to outcompete counterparties with more resources than you. Instead, play against counterparties who you can beat. The dumber the counterparty, the better.

Choose positive sum games over zero or negative sum games. Positive sum games subsidise losses and boost wins, while negative sum games constantly extract value from you as you play.

good read. thanks for keeping it concise.